Posted on December 26, 2019 You are including your teenager to your vehicle insurance policy. The statement is lots of people's best anxieties. It's the moment they've feared coming due to the stress and anxiety it brings on. Though the high prices are inevitable, there are methods to lower them, as well as you should not need to withstand it for too lengthy.

cheaper auto insurance insurance cheap auto insurance affordable

cheaper auto insurance insurance cheap auto insurance affordable

Likewise, please note that these percentages are the typical percent rise for including a 16-year old driver. As your chauffeur grows older, you can expect reductions to their prices. We understand that isn't what you want to hear, but there are options available to reduce the price of including a teen to your car insurance. credit.

Certifications for these discount rates can include maintaining a specific grade point average or finishing a service provider authorized safe driving training course. If you have an university student that lives greater than 100 miles far from residence without a vehicle, you might additionally get a price cut as they might not be about to make use of the auto as frequently (cheap car).

Some automobiles are more expensive to guarantee than others. When browsing for your teen's first automobile, you desire something bigger in dimension as well as slower.

There's no requirement Look at this website to begin paying when you don't need to. Examine with your carrier to see what their regulations are as they differ from each various other. car insured. Being aware of these guidelines can assist you know what costs to expect and when.

Car insurance coverage costs are personalized to every chauffeur. Teenager motorists commonly pay the greatest prices for cars and truck insurance policy, according to sample price information. Young drivers who are newly licensed absence experience behind the wheel as well as are statistically most likely to get involved in accidents than drivers in any various other age.

car insurance insure vans cheapest auto insurance

car insurance insure vans cheapest auto insurance

Bankrate drew sample auto insurance coverage estimates for teenager motorists from several of the leading providers as well as identified a handful of trusted insurance policy firms that offer even more affordable rates for teens. Secret takeaway Allstate, Geico, Progressive and State Ranch are a few of the very best auto insurance business for teens, based on typical prices, available discounts, customer complete satisfaction and even more, according to our research.

low-cost auto insurance insured car insured car cheaper car

low-cost auto insurance insured car insured car cheaper car

Teenagers aged 16 and also 17 are legally considered minors and will likely need to be noted on their parents' vehicle insurance coverage policy instead than having a different policy. Teenagers aged 18 and also 19 can generally remain on their moms and dads' policy unless they relocate out of their moms and dads' home for a reason aside from university.

These high scores make Allstate a strong choice for policyholders with teenager chauffeurs, specifically those who really hope to handle their plans online. Allstate uses auto, house, life, company and also various other insurance policy products for households, including those with young motorists - cheaper car.

Getting The How To Add A Teen Driver To Your Car Insurance - Reviews.com To Work

7 GPA as a permanent student. Geico: 4. 73/5Geico tied with State Ranch for having the highest Bankrate Rating on our list (automobile). The business scored highest possible in the financial strength and modern technology groups, thanks to its user friendly mobile app and online portal. Like Allstate, Geico provides a large range of insurance policy items for parents and also young drivers.

cheaper car insurance car suvs insurers

cheaper car insurance car suvs insurers

State Ranch: 4. If you're looking for a monetarily steady provider with a first-class mobile app as well as online site, you may desire to take into consideration State Farm.

You can obtain a discount rate for packing your policies, taking a defensive driving training course, having an automobile with innovative safety and security attributes and a lot more. In the table below, you can see State Farm's average automobile insurance coverage costs for teens included in their parent's plan. These sample rates show the added price, not the total expense.

Additionally, participating in the Steer Clear program is one more method for young people under 25 to save as much as 20% on vehicle insurance premiums, if they show safe driving behaviors. Typical expense of car insurance for teen chauffeurs, The average expense of car insurance policy varies for man as well as women young vehicle drivers, with female teen vehicle drivers generally paying less than males.

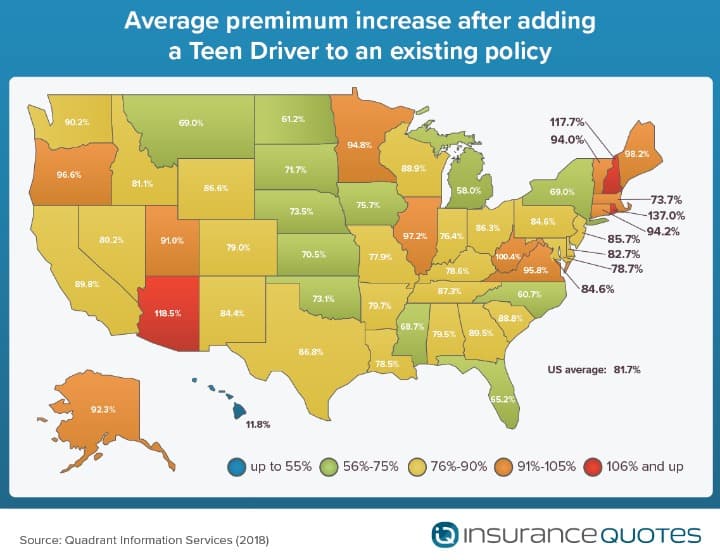

By keeping a tidy driving record and also making the most of discount rates, teen motorists can normally anticipate lower cars and truck insurance costs with each plan renewal (money). Around the age of 70, cars and truck insurance costs typically begin to boost once more slightly. Typical vehicle insurance coverage expenses for teenager motorists by state, The state where you live additionally affects your teen motorist auto insurance costs, as illustrated in the table listed below.

The Only Guide for Tips For Managing Teen Driver Insurance Costs

Florida has the most costly prices for automobile insurance coverage when adding a young motorist to their parents' plan. These rates are based on the top insurance companies in the country as well as are for complete protection vehicle insurance policy for teenagers added to their parents' plan and also hence reflect included expense and not the complete expense - cheap car insurance.

Particular automobiles included much more innovative security functions, which might minimize a cars and truck insurer's danger, and also therefore, reduce your premium. However, a few of those advanced safety functions could really drive your expenses higher as they can be pricey to fix. On top of that, automobiles have different accident statistics.

If you drive an older vehicle that you have outright, you would not be called for to have extensive insurance coverage or crash coverage. Price cuts for teenager motorists, Teen chauffeurs as well as young adults might be able to reduce their automobile insurance premiums by profiting from a few of the finest vehicle insurance price cuts for pupils and different other discounts.

0 or above average. As kept in mind above, Allstate just requires a 2. 7 GPA. The amount of cost savings as well as qualification criteria differ by business, as does how often the young chauffeur has to recertify their qualities. Distant pupil price cuts, A remote student price cut, additionally called pupil away at school, is another means to conserve for college-aged vehicle drivers.

Motorist training discounts, Driver training programs not only make teenage vehicle drivers much safer as well as a lot more accountable behind the wheel, however they might additionally conserve money on cars and truck insurance coverage. The requirements as well as financial savings differ by provider. Usage-based program discount rates, Most insurance policy firms provide a method for all member of the family to conserve on auto insurance with a usage-based program, also called a telematics program (low cost auto).

Some Known Incorrect Statements About Should Your Teenager Have Their Own Car Insurance Policy?

Get rate quotes to assist you find the most affordable plan for your circumstances. Does the average automobile insurance premium vary considerably amongst states?

These are sample prices and must just be utilized for relative objectives. prices. Rates were computed by reviewing our base profile with the ages 16-70 (base: 40 years) used and also shows the expense of adding those ages to their moms and dads' plan (Bankrate's base premium). Hawaii does not make use of age as an identifying consider calculating premiums.

vans trucks insured car car insured

vans trucks insured car car insured

Say hey there to Jerry, your new insurance agent. We'll call your insurer, review your present strategy, after that find the protection that fits your demands as well as saves you cash.

Car insurance companies are mostly interested in one point: Are you a secure vehicle driver or a high-risk one? The solution to that question is going to be the most crucial element in identifying what you pay each year for your policy. The much safer (as well as more skilled) you are behind the wheel, the less costly a brand-new insurance coverage will be.

"Age has the most significant influence on your price because young drivers with no experience have actually statistically shown to be a lot more premature behind the wheel. Which causes extra insurance claims, making them much a lot more expensive to insure. To put it simply, the more youthful the chauffeur the higher the price." It's demonstrably real that teen motorists are the riskiest group when traveling today.

What Does Car Insurance Policies For Young Drivers Mean?

"Teens are two times as most likely to be associated with a mishap and also half more likely to be involved in a casualty. Anytime you add a chauffeur that is most likely to be associated with more crashes along with more major crashes, the surge in insurance coverage costs will certainly be high. cheapest car." The bright side for parents is that teenager driving data is trending in the ideal direction, even if the needle moves slowly toward raised safety.

Deadly accidents fell 59 percent for 17-year-olds, 52 percent for 18-year-olds, and 47 percent for 19-year-olds (cheaper car). "When you take a look at the last 15 years approximately, as states have applied these programs, there has been a great deal of success in decreasing deadly collisions," says Anne Mc, Cartt, the highway safety institute's senior vice head of state for study.

According to Barry, that's due to the fact that insurers know young males are statistically riskier chauffeurs than young ladies. The research found that adding a male teen to a wedded couple's policy results in a nationwide typical premium boost of 93 percent (up from 89 percent in 2017).

Age additionally plays a significant duty in establishing premium boosts. The average premium increase is highest for a 16-year-old man motorist (112 percent) as well as decreases each year with age 19, when costs increase by 70 percent, on average. The average premium boost for females is additionally highest possible at age 16, resulting in an ordinary spike of 87 percent.

"Driving well takes technique, as well as considering that all teens are brand-new motorists they make all type of blunders that more skilled chauffeurs can avoid," says Eli Lehrer, head of state of the not-for-profit R Road Institute. "Additionally, teensparticularly male teens are inclined towards all type of foolish intentional actions that they at some point grow out of." Once more the insurance coverage, Quotes study located that not all states are produced equivalent when it concerns the expense of guaranteeing a teenage vehicle driver (cheaper).

Our How Much Is Car Insurance For A 16-year-old ... - Financebuzz Diaries

In Hawaii, nevertheless, the typical boost is just 12 percent. Right here are the 5 most expensive states for auto insurance coverage, usually, for including a teenager driver to a current car policy: Meanwhile, below are the five least pricey states, typically, for adding a teen driver to an existing vehicle plan: As always, the reasons behind these distinctions are somewhat made complex and also hard to determine, however it begins with the fact that each state regulates insurance differently, and those regulative distinctions make up some of the variants in the study's findings. insurance.

That suggests teens really do not pay far more than adults for automobile insurance. This may likewise account for lower boosts in states like Michigan and also North Carolina, where insurance coverage is controlled even more rigorously as well as score elements are stricter, which indicates it's harder for private insurance firms to raise as well as reduced costs - insure.

"The states with little differences are states understood for having really strenuous price regulation. In those states, motorists who have far better cases behavior and much better features pay greater than they must in order to subsidize teens." Therefore, Lehrer adds: "Everyone understands that teenagers misbehave motorists - insurance. If you're a great driver as well as stay in a state where young adults aren't paying a great deal extra for auto insurance coverage, you're nearly certainly paying greater than you truly should for car insurance." No matter the cost incurred by insuring a teenager chauffeur, safety remains the main concern for moms and dads.